Aug 27, 2025

The Complete Guide to ACH Transfers: How to Reduce Float and Accelerate Payment Processing in 2025

Electronic payment processing has become the backbone of modern business transactions, with ACH transfers leading the charge. If you're looking to optimize your payment workflows, reduce settlement times, and minimize float, understanding the intricacies of ACH and Same Day ACH processing is crucial. This comprehensive guide breaks down everything you need to know about ACH transfer optimization, from basic concepts to advanced strategies that can cut your settlement times by up to 50%.

Jul 30, 2025

Enhanced Customization and Options Now Available for Our Check Products

When Checkbook was founded, our objective was clear: to increase the ability for digital payments and modernize how businesses handle transactions. We've built a robust digital payment infrastructure that helps thousands of companies streamline their operations and reduce costs. However, we consistently hear from customers that despite the digital transformation, there are still scenarios where physical checks remain necessary. Whether it's regulatory requirements, specific industry needs, or simply customer preferences, the demand for reliable check solutions persists. Rather than ignore this reality, we've continued to enhance our comprehensive check offerings to ensure businesses have every tool they need.

Jun 18, 2025

The Complete ACH Return Codes Guide: Master Payment Processing in 2025

Complete guide to all 85 ACH return codes (R01-R85). Learn NACHA requirements, prevention strategies, and handling procedures for payment failures in 2025.

Apr 02, 2025

Streamlining Payments: How Checkbook’s PayPal Integration Revolutionizes Payment Solutions

Checkbook’s PayPal integration, companies can send funds directly to recipients' PayPal wallets—offering an instant, hassle-free payment experience.

Mar 17, 2025

Digital Wallets in Today’s Payments Ecosystem

The rise of digital wallets signifies a fundamental shift in how we manage our finances, moving away from the traditional reliance on physical cards and cash. These applications, also known as an e-wallet or mobile wallet, allows individuals to store funds and conduct electronic transactions outside of their bank accounts.

Feb 27, 2025

Machine Learning for Fraud Prevention in Instant Payments

As instant payments become the norm, securing these transactions has become essential. Machine learning (ML) is revolutionizing fraud detection, bringing real-time payment security to a new level. Checkbook harnesses the power of ML to offer users safe, seamless payment experiences that balance speed and reliability. Here’s a closer look at how this advanced technology functions and the unique benefits it provides to businesses utilizing Checkbook��’s instant payment solutions.

Feb 26, 2025

Virtual Credit Cards (VCCs): A Digital Wallet Revolution

Fintech is buzzing with innovations, and one trend that’s shaping the payment ecosystem is Virtual Credit Cards (VCCs). Gone are the days of misplacing your plastic card or worrying about security risks during online transactions.

Feb 25, 2025

Push to Card: Revolutionizing Fintech Payments

In the dynamic realm of fintech, "push to card" is the latest trend transforming how payments are made in the USA. But what exactly is it, and how is Checkbook leading this innovation? Let's dive in!

Feb 13, 2025

How Checkbook and Digital Wallets Are Transforming B2B Payments

When it comes to B2B payments, the age of cutting checks and waiting weeks for processing is officially over. The modern business world moves at lightning speed, and your payment solutions should too. Enter Checkbook and digital wallets, two game-changing technologies that are redefining how businesses handle payments. From eliminating inefficiencies to boosting security, these tools are taking the guesswork out of financial transactions. Ready to dive in? Here’s how Checkbook and digital wallets are revolutionizing B2B payments, complete with pro tips and insider insights to help your business stay ahead.

Feb 13, 2025

Understanding the Role of a Real-Time Credit Sender

The concept of a real-time credit sender has revolutionized the way money moves, enabling instant access to funds for individuals and businesses alike.

Feb 13, 2025

Why Did I Receive a Real-Time Payment Credit?

Have you ever checked your bank account and noticed a real-time payment credit, wondering, “Why did I receive a real-time payment credit?” These instant transfers are becoming increasingly common as businesses, individuals, and even government agencies embrace faster, more efficient ways to send and receive money. In this guide, we’ll explore the reasons you might receive a real-time payment credit, how these transactions work, and how platforms like Checkbook simplify the process for both senders and recipients.

Feb 13, 2025

Warehouse & Distribution Centers: Overcoming Payment Delays

Rigid payment structures that don’t adapt to modern logistics demands. Fortunately, with Checkbook’s API, businesses can transition from slow, outdated payment systems to instant, seamless transactions, giving them total control over their payment flow.

Feb 12, 2025

How Long Payout Cycles Hurt Influencers & Affiliates

he traditional payment infrastructure used by brands and affiliate networks isn’t designed for speed. But Checkbook is changing that. With faster, flexible payment options, influencers and affiliates can choose how and when they get paid.

Feb 12, 2025

Why Influencers & Affiliates Shouldn’t Wait for Their Paychecks?

Most influencers and affiliates are still paid through bank transfers, PayPal, checks, or wire transfers, all of which come with hidden fees, delays, and unnecessary friction. This is where Checkbook steps in, offering instant, flexible, and cost-effective payment options that empower creators and businesses alike.

Feb 07, 2025

Vendor Payments in Construction

Traditional payment methods like paper checks, ACH transfers, and wire payments are slow, costly, and prone to errors. To keep projects moving, construction firms need fast, secure, and flexible payment solutions, and that’s where Checkbook comes in

Feb 07, 2025

Paying Subcontractors on Time

Reports show that over 80% of construction subcontractors experience cash flow issues due to delayed payments. With traditional methods like paper checks and ACH transfers, payments can take weeks, causing financial strain and project delays. Checkbook provides a modern, digital-first approach that gives construction firms the flexibility to choose between instant and cost-effective payment options. This ensures that subcontractors get paid on time, keeping projects on track and relationships strong.

Feb 07, 2025

Streamlining Logistics Payments

Logistics businesses still depend on paper checks, ACH transfers, and wire payments, which come with processing delays, high fees, and reconciliation headaches. This is where Checkbook, a cutting-edge payment solution, transforms the game, offering instant, cost-effective, and flexible payment options that cater to the unique needs of the logistics industry.

Feb 07, 2025

Revolutionizing Payments in the Construction Industry

One of the most pressing issues in construction is delayed payments, with reports indicating that over 50% of contractors experience cash flow problems due to late payments. This disrupts project timelines and forces businesses to rely on high-interest credit options just to stay afloat.

Jan 31, 2025

ACH vs EFT Canada: The Ultimate Guide to Payment Systems

When it comes to moving money around, the world of electronic payments can feel like alphabet soup. ACH, EFT, what do they mean, and more importantly, how do they impact the USA and Canadian businesses? Let's break it down and uncover everything you need to know about these two financial powerhouses.

Jan 10, 2025

How Instant Payment Systems Impact Financial Inclusion in the USA

The financial landscape in the USA is evolving rapidly, with digital innovations transforming how people access, manage, and spend money. For millions of Americans, instant payment systems have opened up new doors to financial inclusion, enabling underbanked communities to gain access to essential financial services. Here’s how Checkbook's instant payment solutions contribute to this transformation, fostering financial inclusion for all.

Jan 10, 2025

Advanced Use Cases for Virtual Credit Cards

Virtual credit cards have redefined the landscape of digital payments, offering security, control, and convenience for both businesses and individual consumers. Checkbook’s virtual card API provides additional features tailored to modern payment needs, from real-time expense management to seamless integration with digital wallets. In this post, we’ll explore innovative ways to use virtual credit cards, with insights and tips to help you leverage these tools effectively.

Jan 10, 2025

Lowering Operational Costs with Push-to-Card Solution

In Fintech USA, where competition is fierce and every dollar counts, operational efficiency is paramount. Checkbook’s Push-to-Card solution offers a simple, cost-effective approach to managing payouts, helping businesses save on transaction fees, reduce overhead, and enhance financial agility. Let’s explore how this innovative technology can cut costs, improve cash flow, and streamline your financial operations, all while providing an excellent experience for your customers.

Jan 10, 2025

Automating ACH Payments with APIs: How Checkbook Leads the Way in Fintech

The Automated Clearing House (ACH) network has transformed the way businesses handle payments. Today, with Checkbook's ACH API, automating payment workflows has never been easier or more efficient. As fintech continues to grow in the U.S., ACH payments powered by APIs provide an advanced solution that reduces costs, enhances security, and simplifies the payment experience for businesses of all sizes.

Jan 10, 2025

Checkbook's Financial Software: Revolutionizing Payment Solutions

Managing financial transactions efficiently is no longer just a convenience, it's a business necessity. As organizations increasingly rely on digital payment systems, the need for a robust, secure, and scalable solution becomes critical. Checkbook has positioned itself as a leader in this space, offering innovative software that addresses the diverse payment challenges businesses face. From real-time payments to seamless integrations and enhanced security, Checkbook’s financial software offers businesses a streamlined way to manage transactions and ensure secure, timely payments.

Jan 10, 2025

How Checkbook Ensures Operational Resilience and Security

In an era where digital payments are foundational to business operations, operational resilience has become crucial. For Checkbook, a leader in modern payments solutions, resilience means more than just handling day-to-day operations; it’s about ensuring seamless transactions, minimizing disruption, and maintaining high standards of security and performance. Here's how Checkbook enhances operational resilience across its offerings.

Jan 10, 2025

Cybersecurity at Checkbook: Ensuring Secure, Reliable Digital Payments

In the fast-evolving landscape of digital payments, cybersecurity is a top priority. For Checkbook, ensuring the security and privacy of its users is not just a goal but a foundational principle that guides every aspect of its operations. As businesses and individuals move toward more efficient, seamless payment solutions, cybersecurity becomes paramount in maintaining trust and resilience. Here’s a look at how Checkbook safeguards your transactions and sensitive data, ensuring that every payment is secure, no matter how fast or complex.

Jan 10, 2025

Cost-Effective Payment Solutions for Small Businesses

The Value of Affordable Payment Options for Small Businesses For small businesses, every dollar counts. Streamlined, cost-effective payment solutions not only help control operational expenses but also make transactions faster and more convenient for customers. Checkbook is designed with affordability in mind, offering various low-cost options tailored for small businesses, including digital checks, push-to-card, and Account-to-Account (A2A) transfers.

Jan 10, 2025

Revolutionize Payments with Digital Checks

In the digital era, traditional paper checks are becoming a less viable option for businesses that prioritize efficiency, security, and speed. Digital checks are now filling that gap by combining the familiarity of checks with the convenience of digital payments. Checkbook is at the forefront of this shift, offering a robust platform that empowers businesses to streamline their payment processes while enhancing security and reducing costs.

Jan 10, 2025

Empowering Growth with Push-to-Card Payment Solutions

In the modern digital economy, the demand for real-time, accessible payments has grown exponentially. Checkbook’s push-to-card technology meets this need, providing a secure, fast, and efficient solution for transferring funds directly to recipients’ debit or credit cards. This innovative method offers an ideal way for businesses to improve customer satisfaction and streamline operations, ideal for sectors that prioritize instant payments.

Jan 02, 2025

Business Growth with ACH Solutions

In today’s competitive financial landscape, businesses must implement efficient and reliable payment solutions to enhance their operations. Checkbook’s ACH (Automated Clearing House) solutions provide a streamlined, secure, and cost-effective approach to managing payments, empowering organizations of all sizes to optimize cash flow and improve operational efficiency. Here’s how Checkbook can help harness the power of ACH for business growth.

Oct 24, 2024

Scaling Your Business with Checkbook’s Real-Time Payments

Checkbook is a pioneer in this space, providing scalable, secure, and flexible RTP solutions that cater to businesses of all sizes. Here’s how Checkbook’s RTP platform offers more than just fast payments—it offers a pathway to business growth, operational efficiency, and improved customer loyalty.

Oct 24, 2024

Checkbook’s Customizable RTP Solutions

Checkbook’s Real-Time Payment (RTP) solutions give organizations the cutting-edge capability to not only speed up transactions but also enhance customer satisfaction and maximize operational efficiency. From vendor payments to customer refunds, real-time financial transactions are driving strategic business growth.

Oct 23, 2024

A2A Payments and Checkbook

A2A (Account-to-Account) payments enable real-time transfers directly between bank accounts, eliminating the need for third-party intermediaries such as credit card networks. This reduces fees and accelerates transaction speeds, making it ideal for both peer-to-peer (P2P) and business-to-business (B2B) payments. Traditionally used in ACH transfers, A2A payments are rapidly gaining traction due to innovations like real-time payment networks and open banking APIs. Forecasts predict a 22% compound annual growth rate (CAGR) for A2A payments over the next five years, reflecting their growing use in online purchases, bill payments, salary disbursements, and more.

Oct 22, 2024

Unlocking Embedded Finance with Checkbook

Embedded finance integrates financial services like payments, lending, and insurance directly into a company's platform, eliminating the need to redirect users to external banking systems. For example, an eCommerce site can embed digital wallets or payment processing, enabling seamless transactions without leaving the platform. This reduces friction, enhances user convenience, and boosts customer engagement. By utilizing APIs and partnering with financial institutions, embedded finance empowers non-financial businesses to offer financial services, creating a streamlined and integrated experience for users.

Oct 22, 2024

Tokenization and Checkbook

Checkbook integrates tokenization into its payment processing system to enhance security, compliance, and fraud prevention.

Oct 22, 2024

The Growing Concerns of Fraud in Digital Payments

Fraud in digital transactions can take many forms, including identity theft, unauthorized transactions, and data breaches. The FTC reported over 2.8 million fraud cases in 2022, resulting in losses exceeding $3.3 billion. These statistics underscore the urgency of implementing comprehensive fraud prevention strategies to protect businesses and consumers in an increasingly digital payment ecosystem.

Oct 22, 2024

EFT Payments

Electronic Funds Transfer (EFT) is a digital process that allows money to be transferred between bank accounts without the need for physical checks, cash, or paper-based transactions. This method is widely used in banking and business to ensure faster, more efficient financial transfers. Common types of EFT transactions include direct deposits, wire transfers, and Automated Clearing House (ACH) payments. These methods provide a secure and reliable way to move funds, offering greater accuracy and speed in handling payments.

Oct 22, 2024

FedNow vs RTP

RTP, launched by The Clearing House in 2017, provides a robust platform for real-time financial transactions, ensuring immediate fund transfers with 24/7 availability. FedNow, developed by the Federal Reserve, was launched in 2023 and provides an alternative rail for real-time payments by enabling broader participation among financial institutions.

Oct 22, 2024

What Is an Instant Payment System?

Instant payment systems, or real-time payment systems, allow for the immediate transfer of funds between bank accounts and cards i.e. stores of value, providing near-instantaneous processing compared to traditional methods that can take hours or days. This technology is rapidly gaining global traction, with many countries adopting their own instant payment networks. They key to note is the difference between a push payment and a pull payment. Many Instant Payment systems allow the holder of the bank account or wallet to push funds from that account/wallet to another account/wallet. However there are very few Instant Payment system which allow the account/wallet older to pull payments from another account/wallet

Oct 22, 2024

RTP in USA

Real-Time Payments (RTP) have rapidly transformed the U.S. financial landscape, enabling instant fund transfers and settlements. This innovation significantly enhances both commercial and consumer transactions, offering faster, more efficient payment solutions that meet the growing demand for immediacy and security.

Oct 16, 2024

Instant Payments

In today’s fast-paced business landscape, instant payments are essential. Checkbook, a leading fintech company, provides seamless, real-time payment solutions for businesses. Using advanced technology, Checkbook's Instant Pay service allows funds to be transferred to any VISA or MasterCard debit card within seconds, offering 24/7 access without the restrictions of traditional banking hours.

Oct 16, 2024

Digital Banking and Checkbook

The financial landscape is undergoing rapid transformation, with digital banking leading the charge. What began as a basic method for moving money online has evolved into a cornerstone of modern financial management for businesses and individuals alike. As technology advances, the demand for convenience, efficiency, and security in financial transactions has driven the rise of digital banking. Platforms like Checkbook are setting new standards, offering seamless, secure payment solutions that redefine how payments are handled. But what makes digital banking so essential, and how is it reshaping the way payments are made today?

Oct 15, 2024

B2B Billing and Payment Solutions

B2B billing serves as the lifeline of the corporate ecosystem, ensuring smooth operations and financial vitality. By optimizing billing processes, organizations can enhance operational efficiency and solidify business partnerships.

Oct 08, 2024

The Rising Threat of Check Fraud and How Checkbook Mitigates the Risks

Checkbook, a leader in digital payments, is at the forefront of tackling check fraud by leveraging advanced technologies and innovative solutions that provide an extra layer of protection for businesses and consumers alike.

Oct 08, 2024

API Integrations in Fintech

As digital payment processes demand fast, secure, and scalable solutions, businesses require efficient integrations. Checkbook's Open API offers a powerful yet simple way to integrate diverse payment methods into existing platforms, whether for startups or enterprises. By automating payments, Checkbook's API reduces manual tasks and enhances user experience. In the rapidly evolving fintech industry, API integrations are driving innovation and efficiency. As a leader in digital payments, Checkbook demonstrates how robust API integrations can transform financial services.

Oct 08, 2024

Payment API

In today’s digital landscape, seamless online transactions are vital for businesses and consumers. Payment APIs act as the backbone of this process, enabling secure and efficient integration of payment solutions into platforms. They simplify transactions, enhance security, and provide access to global markets. As e-commerce continues to grow, leveraging Payment APIs boosts efficiency, expands reach, and improves customer satisfaction, making them essential for businesses of all sizes.

Oct 08, 2024

Risk Management and Monitoring in Checkbook

Checkbook, a leader in digital payment solutions, exemplifies this approach by leveraging advanced technology and strategic partnerships. Its robust infrastructure ensures efficient, secure payment processes, reducing risks tied to real-time financial transfers and reinforcing its position as a trusted name in fintech.

Oct 08, 2024

ACH Transfers vs Wire

ACH transfers and wire transfers are two widely used methods for moving money between bank accounts. While both facilitate fund transfers, they differ in key aspects, making each suited for different financial needs.

Oct 08, 2024

What are Small Business Payment Processors?

Payment processors facilitate the secure transfer of transaction data among merchants, banks, and customers, enabling the acceptance of debit and credit card payments. These services are essential for businesses, ensuring efficient processing and operational continuity.

Sep 16, 2024

Wire Transfer vs Bank Transfer

A wire transfer is an electronic method of transferring funds between individuals or entities, typically for larger amounts. This process is fast and efficient, with funds moving directly between bank accounts. A wire transfer could be domestic or international A bank account transfer, simply "bank transfer" or Electronic Funds Transfer (EFT), involves moving money electronically from one bank account to another. Bank transfers can be intra-bank i.e. from an account at one bank to an another account at the same bank or inter-bank i.e. from a bank account at one bank to abnk account at another bank. This broad term encompasses methods like ACH (Automated Clearing House) transfers, direct deposits, and person-to-person payments through apps such as Venmo or other mobile wallets. Bank transfers are typically used for domestic transactions and are often free or low-cost for the sender, distinguishing them from wire transfers.

Sep 16, 2024

What is Same Day ACH?

Same Day ACH transfers offer a payment solution within the Automated Clearing House (ACH) network, enabling banks to send and receive ACH files on the same business day. This reduces the traditional ACH processing time by up to 1 business day. If the regular ACH transaction would take 4 business days the same day ACH will take 3 business days for the funds to clear.

Sep 16, 2024

What is a VCC Card?

A VCC is a digital version of a traditional credit card, designed for online transactions. Unlike physical cards, a VCC consists of a card number, expiration date, and security code, enhancing payment security. This digital payment method, also referred to as a digital credit card or virtual card, conceals actual bank details during transactions, reducing fraud risk. As consumers increasingly ask, "What is a VCC card?" and "What is a digital credit card?", the VCC emerges as a key tool for safer, more efficient online payments, reflecting the future of secure digital finance.

Sep 16, 2024

What is Push to Debit?

"Push to debit," a subset of "push to card" transactions, is transforming digital payments by enabling funds to be transferred directly to a cardholder's debit card. Unlike traditional methods that require extended processing, this technology facilitates real-time, 24/7 access to funds, significantly improving payment efficiency.

Sep 05, 2024

How Long Does a Wire Transfer Take

Domestic wire transfers, conducted within the same country, typically complete within 24 hours, often on the same day if initiated during bank hours. Transfers made after the cut-off time are usually processed the next business day.

Aug 15, 2024

Why Did I Get a Real-Time Payment Credit?

Receiving an unexpected real-time payment credit can be exhilarating but also confusing; however, it is just a faster and more efficient method of receiving funds.

Aug 15, 2024

What Is A Virtual Credit Card?

A virtual credit card is a digital version of a traditional credit card, existing solely in electronic form. It offers the same functionality as a physical card but with enhanced security and flexibility for online transactions. Unlike traditional plastic cards, a virtual card operates entirely online, containing all essential details like card number, expiration date, and security code, but without a physical presence.

Jul 29, 2024

ACH vs Canadian EFT

In the realm of digital banking and transactions, understanding the nuances between different money transfer methods is essential for both consumers and businesses. Distinguishing between ACH payments, commonly used in the United States, and Canadian EFT payments, a staple in Canadian banking, is a common point of confusion.

Jul 29, 2024

What is an ACH Credit Payment

Automated Clearing House (ACH) payments are a widely used form of electronic money transfer in the United States. An ACH credit payment involves funds being transferred into a bank account as opposed to ACH Debit which is used to pull funds out of a bank account. Third party payment processors typically use a clearing bank which originates ACH transactions for the processor To complete a payment from one entity to another the processors' bank will act as the ODFI (Originating Depository Financial Institution ) and send an ACH Debit to pull funds out of the Payor's account. It will then create an ACH Credit transaction to push funds into the Payee/Receiver's account

Jul 29, 2024

How long does a bank transfer take?

Understanding the intricacies of bank transfer times is vital for effective transaction management, whether one is a seasoned banker or new to online banking. Transfer durations vary depending on factors such as the banks involved and the chosen transfer methods.

Jul 29, 2024

What Is an ACH Routing Number?

In the intricate landscape of financial transactions, understanding the distinct roles of ABA and ACH routing numbers is essential. ABA routing numbers, commonly referred to as check routing numbers, facilitate paper or check-based transfers. Conversely, ACH routing numbers are integral to electronic fund transfers. Despite their apparent similarity, these numbers fulfill unique functions within the banking system.

Jul 10, 2024

Real-Time Payments: Understanding the Future of Money Movement

Since the first live RTP™ payment in November 2017 and its initial volume increase in 2019 with PayPal's use case, RTP™ has been on an upward trajectory, revolutionizing financial transactions with unparalleled speed and efficiency. Citing RTP™ volumes from TCH, the growing demand underscores the critical innovation of real-time payment systems in today's financial landscape.

Jun 04, 2024

FedNow: Hype or reality?

FedNow is an interbank instant payment infrastructure that aims to transform payments in the US. FedNow Instant Payments, launched by the Federal Reserve on July, 2023, promising to transform how money moves electronically. It had been in planning for 4+ years.

May 22, 2024

Push to Card Payments Explained

In today's fast-paced digital world, the ability for real-time transactions is no longer a luxury—it's a necessity. Push to Card payments are leading this charge, offering a swift, secure, and efficient way to transfer funds, any time, any day.

Mar 27, 2024

Understanding ACH Payments: Efficiency, Security, and Digital Banking Evolution

Explore the intricacies of ACH payments in this comprehensive blog post, delving into its role in modern banking infrastructure, efficiency, security measures, and future outlook. Discover how ACH transfers streamline financial transactions, the benefits they offer, and insights into their safety protocols. Gain valuable knowledge on the workings of ACH transactions, processing times, and their significance in the evolving landscape of digital banking.

Mar 06, 2024

Checkbook & Synctera: Revolutionizing Payments Together

Checkbook Synctera Partnership

Sep 01, 2023

FinTech Funding and Valuation versus Demand and Supply

There’s been a growing rumbling in recent months that fintech is plateauing. After all, now that AI is here, what’s to stop it from demolishing the need for fintech innovations altogether?

Jul 11, 2023

The Anatomy of a 99% Completion Rate

Most payments happen without payors or recipients ever having to think about them. And that’s the way it should be—in a perfect world, every transaction would be seamless. But it’s not a perfect world, and the reality is that only between 92–95% of payments are completed successfully. While at first glance, that statistic may not be jarring, but think of it this way: what if your paycheck bounced 8% of the time? Suddenly 92% seems a far cry from acceptable.

May 26, 2023

How The Money Flows: Payments for Cash Advance

There’s probably been a time in your life when you had an unexpected emergency arise and didn’t have the money to address it until your next paycheck. If you don’t have friends or family to help, there aren’t many reputable solutions that can get you money quickly. That’s where cash advance comes in: it’s a short-term lending tool designed to bridge the financial gap between paychecks. Here’s a look at the cash advance industry as a whole and how changing market conditions have made faster payments a necessity.

Apr 21, 2023

Top Takeaways from Nacha's Annual Conference

Nacha’s annual conference is the place to be if you’re in the payments industry, and this year’s event—Smarter Faster Payments 2023—was no exception

Mar 29, 2023

Building Creativity - Hackathons with Checkbook

Each year, over a thousand intrepid hackers gather on the Stanford University campus for a 3-day hackathon that involves laser tag, yoga, and a whole lot of brain power. Participants are given tracks from which to choose—such as healthcare, sustainability, and education—and from there are given free reign to hack at will, producing projects that tackle some of today’s most difficult problems.

Aug 10, 2022

Unique ways to increase retainment of 1099 contractors

It is a gig economy! Part-time employees, gig workers, and or 1099 contractors are growing in popularity, making up over 30% of this country's workforce. More people in this economy want the freedom to work where they want and when they want in ways that the traditional work environment doesn’t offer.

Jul 19, 2022

Creative ways to send payments & dodge common fees

Paying your bills on time can be something of a chore. Knowing when and how to pay essential bills can be confusing. That is because each bill has varying contract terms. Individuals should understand potential late fees, penalties, and contract terms for each bill.

Jul 05, 2022

Financial Essentials All Businesses Need

For all of you listening to the daily grind of stock market collapse there is good news: The entrepreneur spirit is alive and well and it will once again propel us to higher value creation than ever before. It is now easier, more than ever, to develop a product or tech and launch it to the masses.

Jan 13, 2021

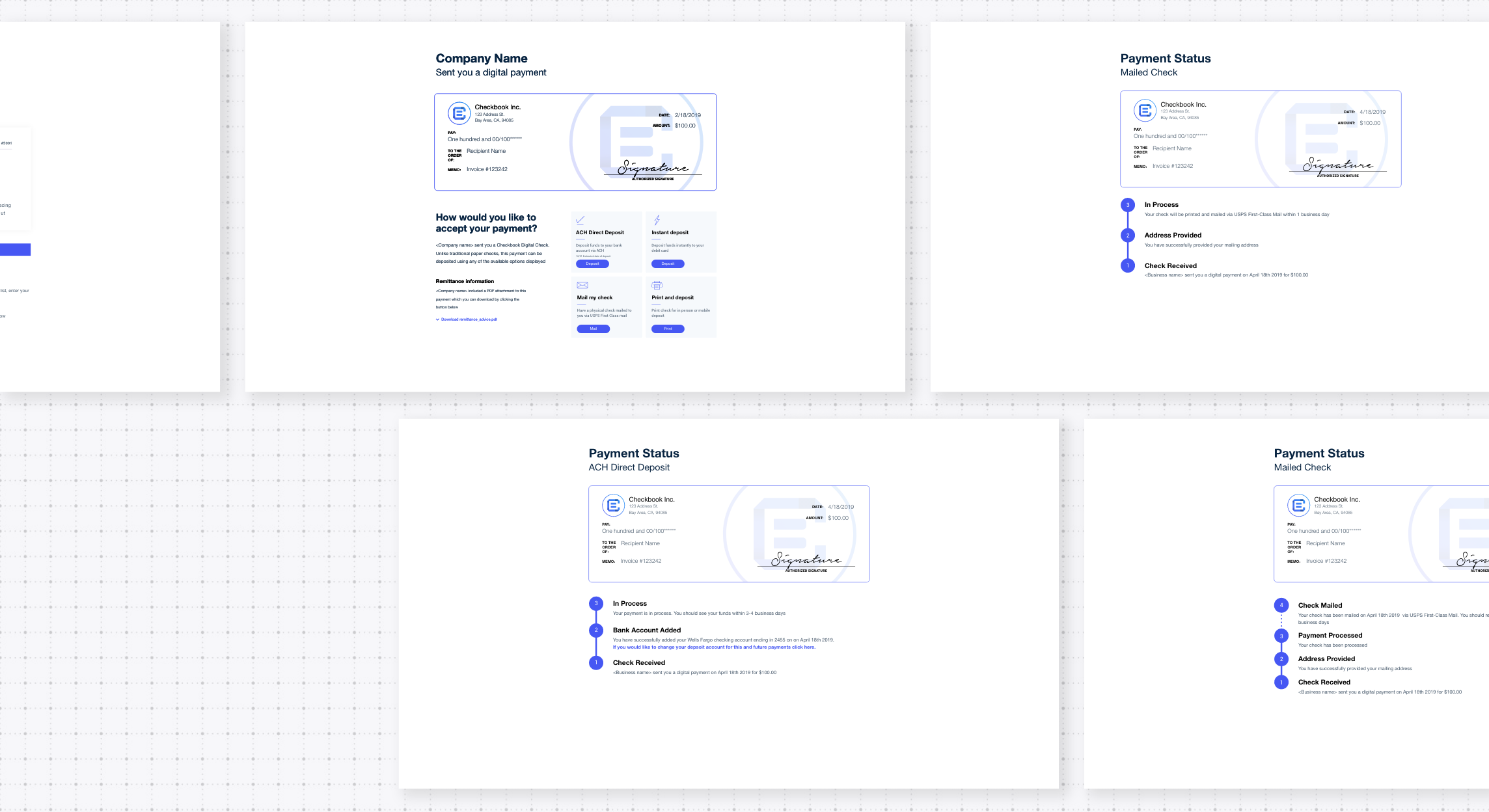

A New Look

Starting Monday, Jan 18th 2021, Checkbook will be rolling out our latest recipient experience UI. These new templates were created to provide our customers and their recipient's with a clean and effortless design philosophy that many have come to expect of modern payment providers.

Sep 17, 2020

What Are ACH Payments?

ACH payments can be confusing. You might have heard they can save your business with payment processing fees, but not sure how. We are going to cover what ach payments are, ach payments processing, and if ach payments are safe.

Aug 17, 2020

Checkbook Integrates With Sage Intacct

Sage Intacct pushes payment information for transactions logged within the system to Checkbook.io and then pulls payment status in real time from Checkbook.io to update and reconcile that on its system.

Aug 11, 2020

Spending Habits For Success

Before you spend, think to yourself, “Is this something I want or something I need?”

Aug 11, 2020

How COVID-19 Will Change the Future of Work

The pandemic of the 21st century has forced more than 20 million Americans out of work. Undoubtedly, the workforce will have to adapt to societal changes caused by this pandemic.

Aug 11, 2020

How To Maintain The Security Of Your Bank Account

All money now is virtual and all of it is stored in the hands of our fiduciary partners, banks. Maintaining the security of your bank account is imperative now.

Aug 11, 2020

How To Build Passive Income

There are many passive income strategies to consider for someone looking to create that extra stream of income.

Aug 11, 2020

Tell Tale Signs of Fraud

With every passing day, cyber crimes in the US are growing and they are getting more innovative, robust and sophisticated. The only way to protect yourself is to be alert and aware.

Aug 11, 2020

Job Security In The Future

Have you ever worried about the relevance of your job? Well, you are not the only one! Most Americans have a love-hate relationship with automation and its consequences and its repercussions on blue collar jobs.

Aug 05, 2020

Fraud Control at Checkbook

At Checkbook, besides sending money and digital checks, we full-on stop fraud. In fact, we boast one of the lowest levels of chargebacks and fraud incidences amongst our peers in the payment processing community by orders of magnitude!

Jul 22, 2020

How Do Marketplaces Work?

Online marketplaces provide easy platforms where consumers can seek specific products or services. These products and services are offered through third-party vendors, purchased by remote customers, and transacted through the online marketplace provider.

Jul 20, 2020

Checkbook vs. Dwolla

Checkbook and Dwolla are two companies that aim to develop technology to overcome the hurdles of traditional payment methods. There is, however, are many distinctions between the two.

Jul 11, 2020

How to Accept Payments Without a Bank Account?

Not everyone has a bank account but this should not hinder them from collecting their funds. There are many secure ways available to such individuals as well.

Jul 06, 2020

5 Reasons Why Paper Checks Are Hurting Your Business

The elimination of paper checks can unquestionably assist businesses and individuals in reducing large costs.

Jul 02, 2020

How To Make Your Savings Boom

Despite Social Security, the average American worries about retirement. This is due to drastically low savings. There are, however, tips and tricks to make your savings boom.

Jun 05, 2020

Security Is Paramount At Checkbook

Our infrastructure was built from the ground up with intense security checks. Checkbook has fraud detection at even the every level of a transaction designed to protect both businesses and consumers.

Jun 03, 2020

What is Instant Pay?

Checkbook's 'Instant Pay' pushes a recipient's funds into their checking account within 18 seconds!

Jun 02, 2020

Why is Checkbook right for you?

The "Last Mile Solution" - No Signup | No Download | Flat Rate | Pay Anyone

Jun 02, 2020

The Exorbitant Costs of Sending Paper Checks

The total economic loss here is insane, especially just to transfer money from one person to another.

Jun 02, 2020

What are Real Time Payments?

Real time payments allow individuals and businesses to, with the push of a button, instantly make funds available for use.

Jun 02, 2020

What is the Difference Between Digital Checks and eChecks?

Digital Check and eCheck certainly sound similar, but the truth is, they couldn’t be more different.

Jun 01, 2020

What is an eCheck?

eChecks (aka. Electronic Checks) are a payment tool that are used to send funds electronically.

May 26, 2020

What is a Digital Check?

Checkbook.io’s Digital Check takes the Paper Check of the past and digitizes it

Feb 05, 2020

How To Choose Your Payments Processor?

Knowing which parameters to assess a firm against when shopping for the ‘right’ payments partner is essential to making a decision that will be an optimal solution for your business.

Jan 28, 2020

To Avoid Fraud, Avoid the Paper-Trail

A paper-trail not only makes a business susceptible to human error, but is also difficult to store and filter through in times of need.

Dec 12, 2019

10 Ways To Get Paid Faster

Follow these 10 steps to make sure you get what you're owed and you get it FAST!

Aug 22, 2019

Integrations To Maximize The Efficiency Of Your Small Business

In addition to time, if you’re like most small business owners, bookkeeping and general finance aren’t at the top of your to-do list, but nonetheless, they could still eat up a lot of your time and attention.

Jan 22, 2019

What is Same Day ACH?

While traditional ACH payments take 3 business days or more to settle, ‘Same Day ACH’ payments, are settled within the same business day.

Jan 21, 2019