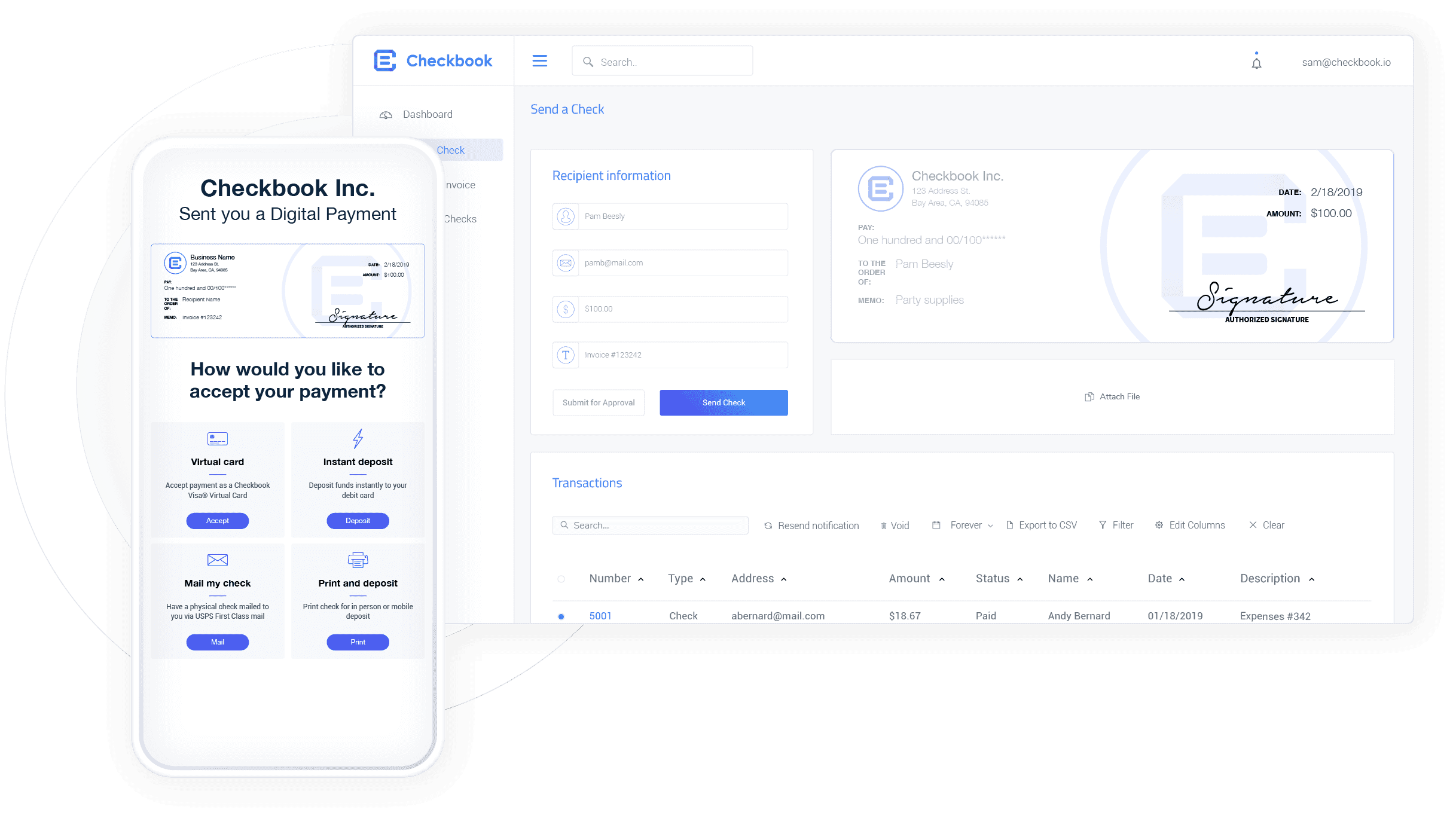

Easy to receive

Checkbook’s Digital Checks support a variety of flexible deposit options enabling recipients to choose the deposit option that best suits their needs. No signup required - simply enter the necessary information at the time of deposit and our tokenized platform keeps your financial data safe and secure.

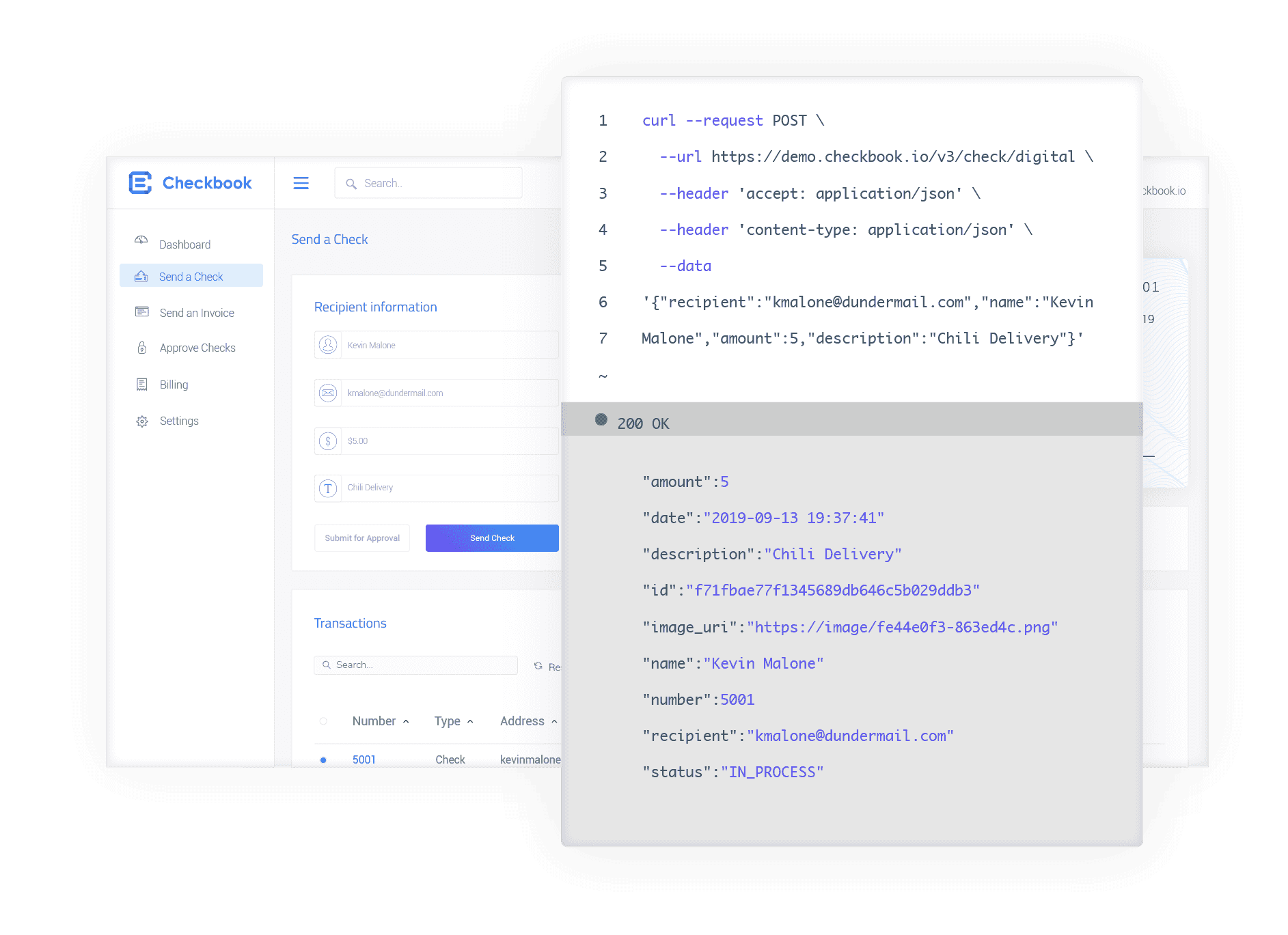

Easy to send

Our Digital Check solution makes payments quick and easy. To send a payment simply enter the recipient's name, email, and the amount - that's it! Whether you are using our RESTful API or our full featured online dashboard, Checkbook offers the tools you need to disburse payments at scale.

You can also use our pre-built integrations including QuickBooks Online and AccountingSeed.

Make it your own

With our White Label Marketplace Implementation, we give you complete control over colors, emails, verbiage, and more. Our white label solution provides a complete set of building blocks to support virtually any business model from mass disbursements to financial service marketplaces.

Whether you're a marketplace for landlords, freelances, or gig economy workers, or even building an accounting platform, Checkbook has the solution for you.