Real-Time Payments: Understanding the Future of Money Movement

Posted by Checkbook on Jul 10, 2024

The first live RTP(™) payment was made in Nov 2017. However it was more than a year until some volume actually started. One of the initial use cases was Paypal disbursing payments using RTP(™) to users with bank accounts in Chase in 2019. Since then RTP has been on an upward trajectory. With the growing demand for faster and more reliable payment solutions, Real-Time Payments (RTP) systems have emerged as a critical innovation in the financial landscape. Real-time payments are transforming financial transactions by offering unparalleled speed and efficiency. What are Real-Time Payments?

Real-time payments, often abbreviated as RTP is a form of faster payments are transactions that are initiated and settled almost instantly. Unlike traditional payment methods where funds transfer can take several days, faster payments ensure immediate availability of money to the recipient. This is a significant upgrade from the lag experienced with older systems.

RTP payments involve account-to-account fund transfers that provide instantaneous availability of funds to the beneficiary. Once a payment is authorized, it is instantly reflected in the deduction from the payer's account, which is why these transactions are also known as immediate or instant payments. Importantly, RTPs are irrevocable, meaning the payer cannot reverse the transfer once it is made.

RTP(™) demonstrates efficiency and compliance, adapting to the fast-paced nature of modern life and influencing the future of transactions. Their availability around the clock, every day of the year, showcases a dedication to improved service delivery and continuous accessibility.

How do Real-Time Payments work?

RTP payments operate through a streamlined process. Initially, the system verifies the availability of funds in the payer's account. Upon transaction authorization, funds are promptly deducted from the payer's account and made accessible to the beneficiary. This real-time processing stands in contrast to conventional methods like Automated Clearing House (ACH) payments, which typically involve batch processing and delayed transactions.

The Process Simplified:

- Initiation: Payer initiated transactions via mobile app or online platform like Checkbook.

- Validation: Payment system confirms payer's account and funds availability.

- Processing: Funds are instantly transferred to the recipient's account.

- Notification: Payer and recipient promptly notified by Checkbook of successful transaction.

Security Measures

- Encryption: RTP systems employ advanced encryption to protect data during transmission.

- Authentication: Multi-factor authentication (MFA) ensures that only authorized users can initiate payments.

- Fraud Detection: Real-time monitoring and machine learning algorithms detect and prevent fraudulent activities.

Industry Use Cases:

- Insurance Industry: In 2022, insurance companies channeled 20% of all payouts through Real-Time Payments (RTP), significantly improving settlement times and enhancing customer satisfaction. ( as compared to 17% in 2021 and roughly 9% in 2020).

- B2B Transactions: RTPs eliminate transaction delays in Business-to-Business (B2B) payments, improving cash flow efficiency and supporting just-in-time inventory management. According to a Mercator Advisory Group Viewpoint on B2B faster payments, 60% of respondents in the Association for Financial Professionals' 2019 payments study indicated that B2B transactions would benefit the most from faster and RTP systems compared to other transaction types.

- International Transactions: According to ACI Worldwide data, RTP transactions totaled $195 billion in 2022, marking a robust year-on-year growth of 63.2%. Projections indicate that the total value is expected to soar to $511.7 billion by 2027. Compliance with ISO 20022 standards and AML/KYC regulations ensures safe and reliable cross-border payments.

- E-Commerce: The Federal Reserve’s FedNow Service enables instant payments, streamlining transactions and enhancing financial accessibility. In 2023, digital wallet usage soared, with efficiency-focused businesses and convenience-driven consumers experiencing significant increases of 31% and 32% respectively. Integration with e-commerce platforms, tokenization, and end-to-end encryption enhances security and operational efficiency.

Real-Time Payments in the US

Adoption and Growth: The adoption of real time payments in the US has been accelerating. More financial institutions are integrating this feature to meet the growing consumer demand for instant payments.

FedNow Real Time Payments: The Federal Reserve has introduced FedNow, a real time payment service aimed at providing instant payment solutions nationwide. Once fully implemented, FedNow will allow both businesses and consumers to transfer funds instantly, 24/7.

Key Players in Real Time Payments

Real Time Payments Participating Banks

Several major banks are active participants in the real time payments network, including (more here):

- JPMorgan Chase

- Bank of America

- Wells Fargo

- Navy Federal Credit Union

- Real Time Payments Network

The Real-Time Payments Network stands as the premier infrastructure supporting these transactions. It facilitates seamless integration with diverse financial institutions and digital platforms, guaranteeing smooth operation and unparalleled efficiency.

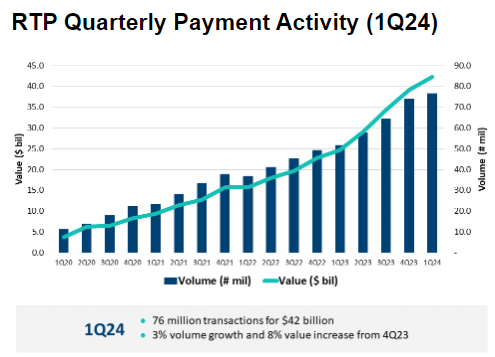

RTP quarterly payment activity

In Q1 2024, The Clearing House RTP network saw record usage, processing 76 million transactions valued at $42 billion. March alone witnessed nearly 27 million transactions, with March 1st setting a new record for the highest number of transactions in a single day, surpassing 1.25 million.(more here)

Future Prospects

The advent of digitalization in everyday activities has elevated expectations surrounding payment systems, leading to the emergence of real-time payments. With continuous advancements and increasing adoption rates, the future of real time payments looks promising.

Prior to the pandemic, real-time payments constituted 8.9% of transaction volume in 2019. Projections indicate that by 2024, this share is anticipated to increase to 20.9%, reflecting a projected compound annual growth rate (CAGR) of 42.1% over the subsequent five years (more here). The forecast also indicates that real-time transaction volume is set to rise from $734 million in 2019 to $4.2 billion by 2024.

RTP's scope extends beyond domestic retail payments, with potential expansion into corporate B2B segments and cross-border transactions. In a conservative growth scenario, Deloitte predicts that real-time payments could potentially replace US$18.9 trillion in ACH (Automated Clearing House) and check-based B2B payments in the United States by 2028(more here). In an aggressive growth scenario, this figure could increase to US$37.0 trillion.

Innovations and regulatory support will likely spur even greater integration across diverse sectors. Regulatory standards like PSD2 drive innovation and encourage the emergence of new business models. Looking ahead to 2026, a significant increase is projected in the US, with an anticipated 8.9 billion real-time transactions, quadrupling the volume recorded in 2022(more here).

Real-time payments are transforming financial transactions, offering remarkable speed, security, and convenience. They have become a crucial feature for both personal and business use, reshaping the landscape of financial operations. Embracing real-time payments can notably enhance financial efficiency as this technology evolves.

Frequently Asked Questions

What are Real-Time Payments (RTP)?

Real-Time Payments (RTP) is a transformative innovation in finance that enables the initiating, sending, and receiving of payments instantly, 24/7, and 365 days a year. This new payment model increases efficiency, meeting consumer demands for instant transactions.

How do RTPs differ from traditional batch processing?

Unlike traditional batch processing, which groups ACH transactions to settle them together daily, RTPs are individually processed in real time. This increases the speed of transactions and offers greater convenience for consumers and businesses alike.

How are Venmo and other mobile payments related to RTP?

Despite offering instant access to transferred funds, mobile payments like Venmo and CashApp are not RTPs. While they may appear to function in real-time for the user, the settlements among banks still occur in batch processing.

Are RTPs the same as wire transfers?

No, RTPs are not the same as wire transfers. Wire transfers often take hours to process and settle and typically work 5 days a week. In contrast, RTPs can be initiated and processed instantly, 24/7, 365 days a year, offering real-time settlement of transactions.

What is driving the growth of Real-Time Payments?

The growth of RTPs is largely driven by the technology's role in enhancing efficiency and meeting consumer demands for instant transactions. Regulations like PSD2 and initiatives such as ISO 20022 also support this advancement, further expanding real-time payments into various payment segments.

Are Real-Time Payments tracked by the IRS?

The IRS does not specifically track RTPs. However, platforms like Venmo that facilitate transactions are required by the IRS to report sales of goods and services exceeding $20,000 and 200 transactions for the tax year 2023.

Can you give an example of a real-time transaction?

A simple example of a real-time transaction is an online credit card purchase of an e-book. This illustrates how information can travel across the Internet instantaneously, providing significant improvements for consumers and businesses.