Push to Card Payments Explained

Posted by Checkbook on May 22, 2024

In today's rapidly evolving digital landscape, the demand for real-time transactions is skyrocketing. Push to Card payments are at the forefront of this revolution, reshaping the way we transfer and disburse funds by offering a swift and efficient solution that outpaces traditional methods.

With Push to Card, we facilitate crediting any eligible payment instrument within minutes, offering seamless access around the clock, every day of the week. Gone are the days of awaiting business hours for fund settlements; this pioneering solution ensures instantaneous disbursements, 24/7. With its broad reach encompassing bank accounts, debit cardsand even prepaid cards, the service caters to diverse needs.

Whether you seek to replenish digital wallets, finalize merchant transactions, or execute swift money transfers, Push to Card stands as a transformative force.

What is a push to card payment?

A push payment initiates when the payer, whether an individual or an institution, decides to transfer funds to a payee. This approach puts the payer firmly in control of the transaction, choosing the amount to be transferred and the destination of funds. Payers utilize tools like FedNow's instant payment system or 'Push to Card' payments to send money promptly and reliably. These platforms facilitate the immediate crediting of eligible payment instruments, from bank accounts to prepaid cards, operating invariably 24/7.

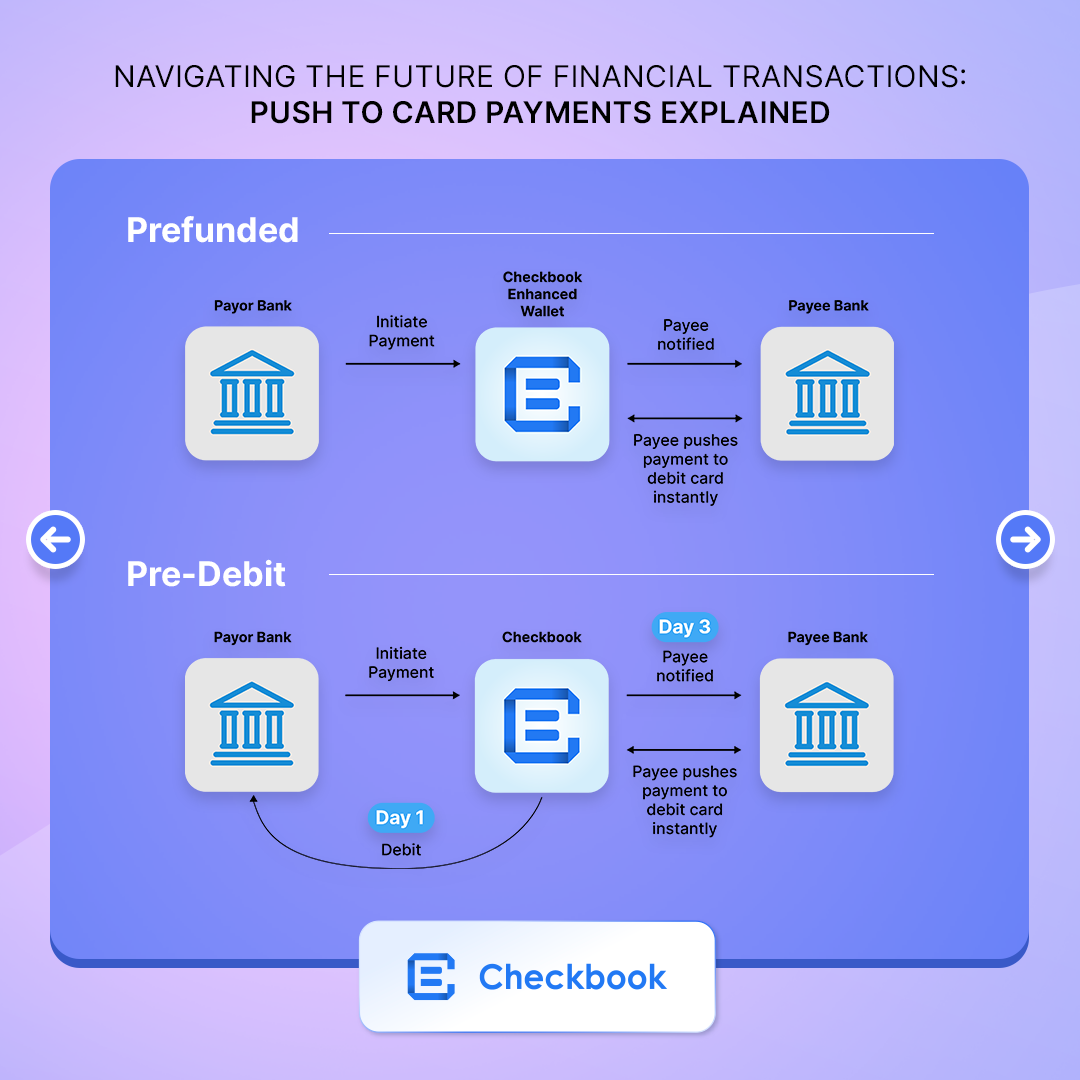

Push Payment Process:

Pros of Push Payments

Speed: Transactions are completed in seconds, which is ideal for urgent payments.

Accessibility: Available 24/7, allowing users to execute transactions outside of normal banking hours.

Enhanced Security: Enhanced safety measures are in place, minimizing the risk of fraud and errors, fostering transparency and trust in the system.

Efficiency: Reduces the need for physical checks and manual processing.

Contribution to Financial Inclusivity: Contribute to financial inclusivity by extending their utility to individuals who may have been previously excluded from traditional banking privileges, thereby promoting greater access to financial services.

Cons of Push Payments

Risk of Late or Missed Payments: The control relinquished to customers may result in late or missed payments. This can create cash-flow challenges and administrative burdens for payees.

Uncertainty in Payment Schedules: Dependence on payer actions can introduce uncertainties in payment schedules, potentially disrupting the stability that businesses aim for in their financial operations.

Checkbook's Push to Card Solution

Checkbook is revolutionizing the way payments are made with its user-friendly, innovative push payment solution. Through its platform, sending payments is as easy as entering the recipient's name and email. This simplifies the transaction process, allowing businesses to efficiently manage payments at scale. Recipients can then engage with Checkbook at their convenience, choosing from a range of payment methods such as direct deposits to their bank accounts or immediate payments to their debit cards.

Seamlessly integrating with existing payment networks, Checkbook facilitates quick and efficient Push to Card Payments. Operating 24/7/365, this method, known as an Original Credit Transaction (OCT) or instant disbursement, sends money to any card in real-time.

While same-day ACH facilitates faster processing, it's important to clarify that it's limited by standard business operating hours. Conversely,Push to card through Checkbook continues to operate outside of these restrictions.

With businesses and financial institutions facing challenges when incorporating instant payments, solutions like Checkbook's Push to Card API significantly simplify the process. The results are real-time, convenient payment experiences that increase both conversions and customer satisfaction.

The system offers a whole new level of immediacy and convenience, vital in today's fast-paced world. No matter where we are heading, instant payment network solutions like Checkbook stand ready to streamline and enhance the experience.

Benefits of Push to Card Payments

Instant Money Transfers: Push to Card payments, facilitated through networks like FedNow, offer quick and secure transfers, addressing the need for rapid transactions in today's digital economy.

Seamless Fund Transfers: Customers can effortlessly transfer funds from their bank accounts to payment cards or make peer-to-peer transfers instantly, enhancing convenience and accessibility.

Direct Application of Rewards and Offers: Loyalty rewards and merchant offers can be directly applied to payment cards, providing cardholders with easy access to redeem benefits without additional steps.

Reliable Transaction Model: For businesses, push payments offer a reliable transaction model with real-time confirmations, ensuring certainty and reducing the risk associated with delays in authorization.

Simplicity and Efficiency: Push to Card payments simplify payment collection processes for businesses, especially with systems like FedNow digital currency, streamlining administrative tasks and allowing businesses to focus on core responsibilities rather than managing invoices.

Push to Card services have revolutionized payments by enhancing conversions, fostering customer loyalty, and boosting satisfaction through real-time fund access. From P2P transfers to enabling immediate access to earnings via direct deposits, and swift funds disbursements, and instant bill payments, its coverage is comprehensive.

Leveraging systems like Push to Card, businesses support various card types for domestic transfers via VISA, MasterCard, or ATM cards, meeting the growing demand for instant payments. Future prospects include facilitating cross-border transfers and transactions with credit cards, cementing our constant pursuit for speed, efficacy, and customer gratification.

How Push to Card Payments Work

Push to card payments utilize existing card networks to transfer funds directly to a recipient's debit card account. Here’s a brief overview:

Initiation: A sender requests to transfer funds to a recipient’s card through Checkbook’s push platform.

Processing: The request is sent through a card network (e.g., Visa, MasterCard).

Verification: Card details and transaction legitimacy are confirmed.

Completion: Funds are deposited directly into the recipient’s bank account linked to the card.

How to Implement Push to Card Payments in Your Business

Assess Your Needs: Determine if faster payment processing is crucial for your operations.

Choose a Provider: Select a payment processor, case in point Checkbook, that supports push to card capabilities.

Integration: Work with your IT team to integrate Checkbook.

Compliance and Security: Ensure that your chosen solution complies with regulatory standards and prioritizes data security.

Future Trends in Instant Payment Systems

Over the past five years, the U.S. payments landscape has seen significant changes, with a shift from cash to digital payments. The onset of the pandemic expedited this shift, particularly reducing reliance on in-person cash transactions. In 2020, there was a notable 7% decline in in-person cash transactions, juxtaposed with a 3% increase in mobile payments during the corresponding period. Push-to-card payments currently extend their reach to encompass over 245 million bank-issued debit cards in the U.S.(more here), with further growth anticipated. Additionally, the adoption of contactless payments experienced a surge in popularity, propelled by the integration of near-field communication (NFC) technology (more here).

The future of instant payments also looks promising with innovations like blockchain technology and real-time cross-border transactions. These advancements will continue to refine and expand the capabilities of systems like push to card payments, making them even more integral to global commerce.

Key Takeaways

Finance trends towards instant payments, driven by innovations like Checkbook's Push to Card, which provides real-time access to funds, enhancing the transaction process.

Push to Card empowers businesses to offer real-time payouts to their customers' VISA, MasterCard, or ATM cards, catering to the increasing demand for convenience and speed in payment experiences.

Checkbook's Push to Card serves to simplify the integration of instant payments into financial systems, increasing desirability, interaction, and customer satisfaction.

Real-time payment experiences, enabled by Push to Card services, drastically increase conversion rates and customer satisfaction by providing immediate access to funds.

Future prospects of this technology hold promise for improved domestic and cross-border transfers using various card types, reflecting the industry's continuous pursuit of speed, convenience, and customer satisfaction.

Frequently Asked Questions

What is the rising demand for real-time transactions?

Real-time transactions, especially those like Push-to-Card payments are in increased demand due to their immediacy and control. They offer quicker, more secure transactions, the ability to apply loyalty rewards, and significantly reduced risks.

What is the difference between 'Push' and 'Pull' payments?

'Push' payments are initiated by the payer, giving them control over the transfer, while 'Pull' payments are set up by the payee. Both methods aim to provide secure and convenient transactions in the evolving digital payment landscape.

Could you provide examples of 'Push' and 'Pull' payment methods?

Brick-and-mortar stores are examples of businesses that use 'Push' payments, with customers initiating payments for their purchases. On the other hand, media streaming platforms typically employ 'Pull' payments, where the service provider withdraws the subscription fee from the customer's account.

How does the insurance industry utilize these payment methods?

The insurance industry often utilizes both methods in a broker model. Here, premiums are collected through 'Pull' payments while claims or other payouts are executed via 'Push' payments.

How is the control aspect different in Push and Pull payments?

In 'Push' payments, the payer has complete control over the transaction details, while in 'Pull' payments, an authorization process is required, commonly used in subscription services and software providers.

Why are instant payment systems like FedNow significant?

Instant payment systems like FedNow increase the effectiveness of push and pull payment methods. They allow for real-time transactions, showcasing how new technologies are revolutionizing the digital payment ecosystem for businesses and consumers.

What are the benefits of Push to Card payments?

Push to Card payments provide instant accessibility to funds, which makes for more efficient business conversions and customer satisfaction. They are ideal for P2P exchanges, direct payroll deposits, and quick disbursements, such as insurance payouts and tax refunds.

Are Push to Card payments suitable for cross-border transactions?

Yes, the Push to Card payment system can facilitate both domestic and potentially cross-border transactions, thereby broadening its utility and applicability.

How quickly can funds be accessed through Push to Card payments?

Funds can be accessed within 30 minutes via Push to Card payments. This feature is very helpful for merchants and customers who favor immediate and efficient transactions.

How does the Push to Card API work?

Push to card API facilitates real-time connection between its customers and issuing banks. This allows for instant transfers to be made, enhancing the efficiency and speed of transactions greatly.

Is Push to Card payment affected by the operational hours of banks?

No, Push to Card operates continuously i.e. 7x24, transcending the limitations set by the operating hours of banks and other financial institutions.

What is the expected impact of the eventual implementation of FedNow Instant Payments?

The implementation of FedNow Instant Payments by the Federal Reserve is expected to work in tandem with the continuous operation of Push to Card payments, reshaping payment experiences and expectations in the financial realm further.